- Analytics

- Technical Analysis

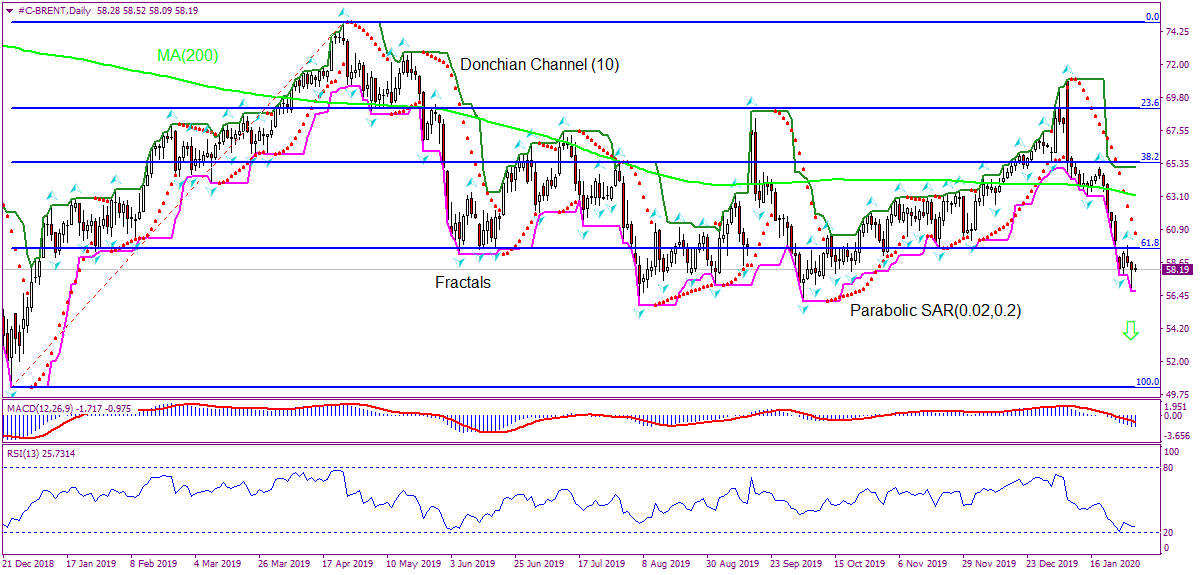

Brent Crude Oil Technical Analysis - Brent Crude Oil Trading: 2020-01-31

Brent Crude Technical Analysis Summary

Below 56.73

Sell Stop

Above 59.84

Stop Loss

| Indicator | Signal |

| RSI | Neutral |

| MACD | Sell |

| Donchian Channel | Neutral |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

| Fibonacci | Sell |

Brent Crude Chart Analysis

Brent Crude Technical Analysis

On the daily timeframe #C- BRENT: D1 has breached below the 200-day moving average MA(200), which is declining. It failed to breach Fibonacci 61.8 resistance level.

We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 56.73. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 59.84. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (56.73) without reaching the order (59.84), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Fundamental Analysis of - "}[/T]

US domestic crude oil stock rose last week. Will the BRENT decline?

On Wednesday the Energy Information Administration reported that US crude supplies rose by 3.5 million barrels. SP Global Platts analysts had forecast a smaller rise of 1.4 million barrels, while the American Petroleum Institute trade group’s Tuesday report estimated a decline of 4.3 million barrels. Rising US crude oil inventories are bearish for Brent. At the same time there have been reports OPEC considers extending output cuts until June, and even a deeper cut from current levels. A rise in geopolitical tensions in Middle East is also an upside risk for oil.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.