- Analytics

- Market Overview

US stocks rise on better than expected data - 5.10.2017

SP 500, Dow extend record streak

US stock market extended the streak of records on Wednesday supported by better than expected data. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, retreated 0.1% to 93.489. The S&P 500 rose 0.1% settling at a record 2537.74 led by utilities and real estate shares. Six out of 11 main sectors of the index closed higher. The Dow Jones added 0.1% to new record high 22661.57 led by gains in Nike and Caterpillar. Nasdaq composite inched up less than 0.1% to 6534.63.

Treasury yields were little changed as investors watched closely who seems more likely to get picked by President Trump as next Federal Reserve chair: former Fed governor Kevin Warsh or current governor Jerome Powell. Warsh is considered more hawkish policymaker than Powell. Fed Vice Chair Fischer expressed his belief inflation would rise eventually, saying the pace of monetary tightening was “OK, it is not terrific”. In economic news a gauge of services sector activity came in stronger than expected: the ISM’s nonmanufacturing index in September hit a 12-year high of 59.8. A number above 50 indicates expansion. ADP’s private-sector jobs report showed 135000 jobs were created in September. The number was lower than 228000 reading in the previous month, in line with expectations of a negative impact from hurricanes.

Bank shares lead European markets lower

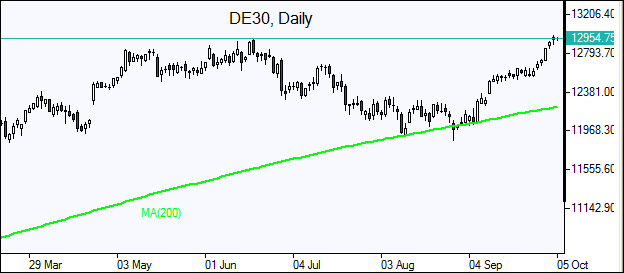

European stocks ended lower on Wednesday on increasing uncertainty spurred by Catalonia independence referendum. The euro continued the rise against the dollar while British Pound ended little changed. The Stoxx Europe 600 index lost 0.1%. Germany’s DAX 30 gained 0.5% to 12970.52 catching up as it opened after a bank holiday on Tuesday. France’s CAC 40 slipped 0.1% and UK’s FTSE 100 edged lower 0.01% to 7467.58. Stocks opened lower today.

Bank shares led the losses with Spain’s banks hardest hit on rising political risks to euro-zone prospect of Catalonia’s possible secession from Spain. King Felipe VI accused Catalan secessionist leaders of shattering democratic principles in a rare televised speech. Catalonia parties requested the regional parliament convene Monday to review the results of this week’s independence vote.

Asian indices flat

Asian stock indices are steady today in thin trading with markets in China and South Korea closed for the week. Nikkei was little changed inching 0.01% higher to 20628.56 as yen climbed against the dollar. Australia’s All Ordinaries Index added 0.01% as Australian dollar erased previous day’s gains against the greenback after unexpectedly weak retail sales report.

Oil rising after larger than expected US inventory draw

Oil futures prices are rising today buoyed by possibility of extension of major oil producers’ output cut agreement. Russian President Vladimir Putin said on Wednesday that a pledge by the Organization of the Petroleum Exporting Countries and other producers, including Russia, to cut oil output to boost prices could be extended to the end of 2018, instead of expiring in March 2018. Prices ended lower yesterday despite the US Energy Information Administration report domestic crude supplies fell by 6 million barrels last week. December Brent crude lost 0.4% to $55.80 a barrel on Wednesday on London’s ICE Futures exchange.

See Also