- Analytics

- Market Overview

US stocks fall on soft data - 6.12.2017

US three main indices decline

US broad stock market ended lower on Tuesday with soft data failing to boost investors’ risk appetite. The dollar strengthened nevertheless: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.2% to 93.08. The S&P 500 lost 0.4% to 2629.57 with only the technology sector out of 11 main sectors ending higher. Dow Jones industrial average fell 0.5% to 24180.64 led by Disney down 2.7%. The Nasdaq composite index slipped 0.2% to 6762.21.

The US trade deficit jumped 8.6% in October to a ninth-month high $48.7 billion. And the Institute for Supply Management’s index of service industry companies fell to 57.4 in November from a 12-year high 60.1 in October. The ISM report showed services sector expansion slowed in November as a reading over 50 indicates expansion. Rising trade deficit and slowing of services sector expansion point to moderating growth prospect for the fourth quarter GDP compared with the previous quarter. The Senate Banking Committee on Tuesday backed the nomination of Jerome Powell as the Federal Reserve Chairman, and the nomination now is expected to be confirmed by the Senate in coming weeks.

Technology stocks drag European markets

European stock indices pulled back on Tuesday led by technology stocks. Both the euro and British Pound extended losses against the dollar. The Stoxx Europe 600 fell 0.2%. German DAX 30 slipped 0.1% to 13048.54. France’s CAC 40 ended 0.3% lower and UK’s FTSE 100 lost 0.2% to 7327.50. Markets opened 0.5%-1.2% lower today.

Technology stocks fell after Monday selloff on Wall Street. UK Prime Minister Theresa May is expected to return to Brussels to continue negotiations with European Union officials after failing to reach an agreement on Brexit issues with European Commission President Jean-Claude Juncker.

Low commodity prices weigh on Asian stocks

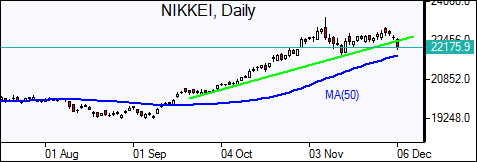

Asian stock indices are falling today dragged by lower commodity prices. Nikkei fell 2% to 22177.04 on stronger yen against the dollar. Chinese stocks continue the retreat: the Shanghai Composite Index is down 1% and Hong Kong’s Hang Seng Index is 2% lower. Australia’s All Ordinaries Index lost 0.5% with Australian dollar hitting the lowest level of the week against the greenback following lower than expected Q3 GDP report.

Oil higher on expected US crude draw

Oil futures prices are extending gains today. Prices rose yesterday supported by the American Petroleum Institute industry group report US crude stocks fell by 5.5 million barrels last week to 451.8 million while gasoline stocks rose 9.2 million barrels. February Brent rose 0.7% to $62.86 a barrel Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

See Also