- Analytics

- Market Overview

US stocks end mostly flat - 16.8.2017

Dow rises while Nasdaq and S&P 500 slip

US stocks ended little changed on Tuesday after Monday rebound following easing of North Korea tensions as Pyongyang backed away from threats to fire missiles at Guam. The dollar strength endured on positive retail sales data: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 93.818. The S&P 500 slipped 1.23 points settling at 2464.61 as losses in telecom and consumer-discretionary stocks offset gains in consumer-staples and utility shares. Dow Jones industrial edged higher less than 0.1% closing at 21998.99 as a 2.6% drop in Home Depot capped the advance of the blue chip index led by gains in American Express and Apple shares. The Nasdaq composite index lost 0.1% to 6333.01.

Treasury yields inched higher after report retail sales rose 0.6% in July, above expectations for a 0.4% rise. Better-than-expected sales data lifted the likelihood of another rate hike this year to above 50% : traders price in 47% likelihood for a quarter percentage point hike at December 13 policy meeting and a 3.4% probability for a half percentage point hike, according to CME Group’s FedWatch tool. Home Depot shares dropped despite positive July sales report and an upgrade in company’s outlook as data showed the uptick in sales was driven primarily by strong demand for new autos and Amazon’s shopping specials. Among other positive data were the jump to 25.2 of the Empire State Manufacturing Index, measuring business conditions in the New York region for August,from 9.8 in the prior month. June business inventories also came in stronger. Today at 20:00 CET minutes from the Federal Open Market Committee’s meeting will be published. Details on an unwinding of the Fed’s balance sheet or a hints of continued hawkish stance of policy makers will be bullish for the dollar.

European markets advance

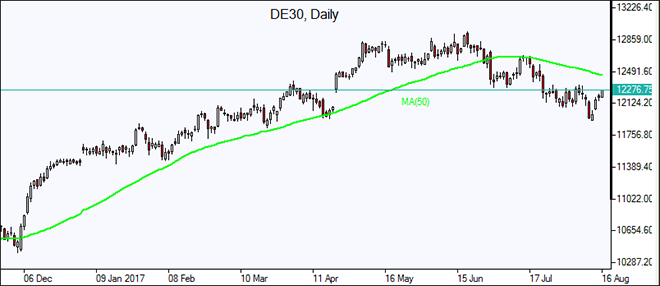

European stocks added to Monday’s gains. The euro and British Pound extended losses on disappointing German GDP and UK inflation reports. The Stoxx Europe 600 inched up 0.1%. Germany’s DAX 30 gained 0.1% closing at 12177.04. France’s CAC 40 rose 0.4% and UK’s FTSE 100 added 0.4% to 7383.85. Stock indices opened 0.4%-0.7% higher today in Europe.

German statistics office Destatis reported Germany’s economy unexpectedly slowed in the second quarter: the GDP expanded 0.6% over quarter compared with 0.7% in the first quarter. And weaker than expected UK consumer price index weighed on British Pound: inflation fell 0.1% on month in July after no change in previous month. Today at 11:00 CET second quarter GDP in euro-zone will be released, the tentative outlook is neutral for euro.

Asian markets mixed

Asian stock indices are mixed today without direction from Wall Street overnight. Nikkei slipped 0.1% to 19729.28 as the yen’s weakening against the dollar slowed. Automaker stocks fell on concerns about US tariff policy as United States, Canada and Mexico start negotiations today to modernize the North American Free Trade Agreement. Japanese automakers are concerned the US will tighten the rules of origin for cars and parts in light of President Trump’s proclaimed “America First” pledge, which will hurt US import of cars from Mexico where Japanese automakers have plants. Chinese stocks are mixed: the Shanghai Composite Index is 0.1% lower while Hong Kong’s Hang Seng Index is up 0.7%. Australia’s All Ordinaries Index is up 0.5% despite a rebound of Australian dollar against the greenback.

Oil higher ahead of US inventory report

Oil futures prices are rising today ahead of the official US inventory report. Prices ended higher yesterday after the American Petroleum Institute reported that US crude supplies dropped 9.2 million barrels last week. October Brent crude rose 0.1% to $50.8 a barrel on London’s ICE Futures exchange on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories. Analysts polled by S&P Global Platts expect a decline of 3.6 million barrels in crude inventories.

See Also