- Analytics

- Market Overview

US stock market slide continues - 30.10.2018

Dollar strengthens while inflation moderates

US stock market remained in downturn mode on Monday on news US is ready to impose tariffs on China if trade talks fail. The S&P 500 slid 0.7% to 2641.25. Dow Jones industrial fell 1% to 24442.92. The Nasdaq composite index lost 1.6% to 7050.29. The dollar strengthening resumed despite soft inflation data: the personal consumption expenditures index, the Federal Reserve’s preferred price gauge, slipped to 2% in September from 2.2% in August. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 96.662 and is higher currently. Futures on stock indices point to higher openings today.

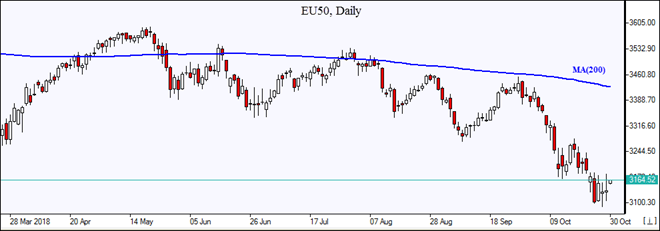

DAX 30 opens higher than other European indices

European stocks rebounded on Monday after S&P Global Ratings left Italy’s sovereign credit rating two notches above junk, though it changed the outlook from stable to negative. Both EUR/USD and GBP/USD turned lower reversing earlier gains but are higher currently. The Stoxx Europe 600 index gained 0.9%. The DAX 30 jumped 1.2% to 11335.48 and France’s CAC 40 added 0.4%. UK’s FTSE 100 rallied 1.3% to 7026.32. Indices opened 0.1% - 0.5% higher today.

Nikkei leads Asian indices rebound

Asian stock indices are mostly higher today after erasing earlier losses spurred by news the US is preparing to announce tariffs on all remaining Chinese imports by early December if November talks between presidents Donald Trump and Xi Jinping fail. Nikkei rose 1.5% to 21457.29 as yen continued slide against the dollar. Chinese shares recovered after China’s securities regulator said it would encourage share buybacks and mergers and acquisitions, and would enhance market liquidity: the Shanghai Composite Index is up 1% while Hong Kong’s Hang Seng Index is 0.7% lower. Australia’s All Ordinaries Index added another 1.3% despite the Australian dollar resumed climb against the greenback.

Brent up

Brent futures prices are recovering today. Prices edged lower yesterday as rising production in the Organization of the Petroleum Exporting Countries and non-OPEC counterparts weighed on the market: December Brent crude lost 0.4% to $77.34 a barrel on Monday.

See Also