- Analytics

- Market Overview

Trade war fears weigh on markets - 15.3.2018

Dow, SP 500 end lower third session

US stocks continued retreating on Wednesday on rising trade war concerns after President Trump’s announcement he is considering tariffs to trim the US’s trade deficit with China by $100 billion. The S&P 500 slipped 0.6% to 2749.48, led by materials and industrial shares. The Dow Jones industrial fell 1% to 24758.12. Nasdaq composite index lost 0.2% to 7496.81.The dollar strengthened slightly: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.1% to 89.75. Stock indices futures indicate higher openings today.

Trade war concerns weigh on market sentiment with stock valuations at historical highs. Recent changes in White House personnel add to policy uncertainty. Trump appointed Central Intelligence Agency Director Mike Pompeo Secretary of State and named Lawrence Kudlow, an economic commentator, as director of the National Economic Council. Kudlow has supported Trump’s tax cuts but opposes tariffs. Economic data were positive: the producer price index showed wholesale inflation up 0.2% in February, above expectations of an 0.1% rise. Retail sales fell 0.1% in February, the third straight monthly decline. However, sales excluding autos and gas grew 0.3%.

DAX edges higher while European indices slip

European stocks extended losses on Wednesday erasing earlier gains as Wall Street slide continued. Both the euro and British Pound turned lower against the dollar. The Stoxx Europe 600 fell 0.2%. Germany’s DAX 30 rose 0.1% settling at 12237.74 helped by Adidas’ 11% jump on outlook upgrade. France’s CAC 40 lost 0.2% and UK’s FTSE 100 slid 0.1% to 7132.69. Indices opened 0.1% - 0.4% higher today.

Euro fell after a speech by European Central Bank President Mario Draghi in Frankfurt suggested the ECB may keep interest rates low in the medium term. He said “there is a very clear condition for us to bring net asset purchases to an end: we need to see a sustained adjustment in the path of inflation toward our aim, which is a headline inflation rate of below, but close to 2% over the medium term,” and that “the performance of underlying inflation remains subdued compared with previous recoveries.”

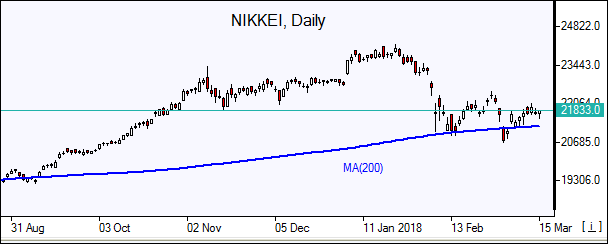

Asian markets mixed

Asian stock indices are mixed today with traders wary about possible trade war after President Trump’s move to impose import tariffs. Nikkei ended 0.2% higher at 21810.50 despite continued yen strengthening against the dollar. China’s stocks are higher: the Shanghai Composite Index is 0.01% higher and Hong Kong’s Hang Seng Index is up 0.3%. Australia’s All Ordinaries Index is down 0.2% despite Australian dollar’s turn lower against the greenback..

Brent slides

Brent futures prices are retreating today on rising US crude output. Prices rose yesterday as gasoline futures advanced after report US gasoline supplies fell while crude supplies rose. The US Energy Information Administration reported Wednesday that domestic crude supplies rose by 5 million barrels last week but gasoline stockpiles dropped 6.3 million barrels. May Brent crude rose 0.4% to $64.89 a barrel on Wednesday.

See Also