- Analytics

- Market Overview

House budget approval supports US stocks rally - 6.10.2017

All three main US stock indexes hit new record highs

US stock market advanced to new record highs on Thursday after Congress passed a budget resolution. The dollar resumed strengthening: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.4% to 93.895. Dow Jones industrial average rose 0.5% to all-time high 22775.39. The S&P 500 gained 0.6% settling at fresh record high 2552.07 sixth session in a row led by technology and financial shares up about 1%. The Nasdaq index advanced 0.8% closing at new record high 6585.36.

Treasury yields inched higher and Investors’ risk appetite was boosted after House passed a $4.1 trillion budget, which is considered as a first step to enacting US tax code overhaul. President Trump’s tax cut proposal, which was supported by leaders of House and Senate last week, may enhance companies’ earnings as lower tax rates get enacted. More Fed officials voiced their support for continuing rate hikes. Philadelphia Fed President Patrick Harker, a voting member of the rate-setting Federal Open Market Committee, said the Fed would likely raise rates in December. San Francisco Fed President John Williams, nonvoting member, said the central bank should stay the course and raise rates. Further positive data were released: factory orders for August rebounded to 1.2% from a 3.3% drop in July, suggesting a likely acceleration In US GDP growth in fourth quarter as business investment rises. Today at 14:30 CET nonfarm payrolls will be released. A decline from August’s solid 156000 new jobs created is expected due to hurricanes impact.

European stocks rise on Catalan parliament suspension

European stocks advanced on Thursday after Madrid suspended a parliamentary session in Catalonia to prevent the region from declaring independence. Both euro and British Pound fell against the dollar. The Stoxx Europe 600 closed 0.2% higher. Germany’s DAX 30 closed marginally lower at 12968.05. France’s CAC 40 rose 0.3% and UK’s FTSE 100 gained 0.5% to 7507.99. Indices opened mixed today.

After Catalan President Carles Puigdemont said on Wednesday he’s open to a mediation process but central government has rejected this Spanish Prime Minister Rajoy said Thursday he has asked Puigdemont to not go ahead with plans to declare independence next week. Spain’s constitutional court has ordered that a special session of Catalonia’s parliament planned for next week to be suspended temporarily. The European Central Bank released the minutes showing officials discussed how to scale back ECB's large bond-buying program at the September policy meeting.

Asian markets advance

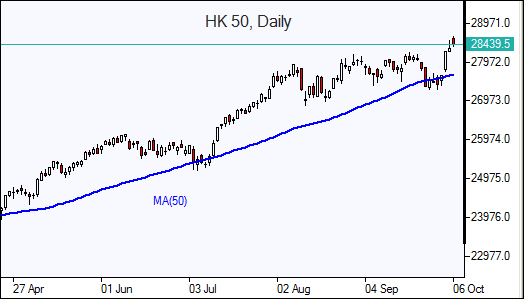

Asian stock indices are higher today ahead of closely watched US nonfarm payroll data. Nikkei ended 0.3% higher at 20690.71 posting 1.6% gain over month as yen’s slide against the dollar resumed. Hong Kong’s Hang Seng Index is 0.1% higher following a holiday on Thursday. Hang Seng Index is up 29% year to date. Australia’s All Ordinaries Index is up 1% as the Australian dollar extended losses against the greenback.

Oil edges lower as tropical storm approaches Gulf of Mexico

Oil futures prices are inching lower today as storm Nate approaches US Gulf of Mexico triggering production and refinery closures. Prices rose yesterday supported by talk of possible OPEC extension of output cut deal to 2018 end as Saudi King Salman visited Moscow. Saudi Arabia made no firm pledge to extend a deal between OPEC, Russia and other producers but said it was “flexible” regarding suggestions to prolong the pact until the end of 2018. Brent for December settlement rose 2.2% to end the session at $57 a barrel on the London-based ICE Futures exchange on Thursday.

See Also