- Analytics

- Market Overview

Dovish Fed minutes weigh on dollar - 17.8.2017

Dow closes above 22000

US stocks ended higher on Wednesday as investors’ risk appetite was boosted by dovish Fed minutes. The dollar erased most of its previous day gains: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed down 0.4% at 93.472. The S&P 500 rose 0.1% settling at 2468.11 led by gains in materials stocks. The Dow Jones industrial average added 0.1% to 22024.87 in a fourth winning session in a row. Nasdaq gained 0.2% to 6345.11.

Stocks rose reversing earlier losses and Treasury yields fell after Fed minutes revealed a few policy makers said the bank could “afford to be patient" before raising interest rates again as they saw a greater likelihood that "inflation might remain below 2% for longer than currently expected." Most central bank policy makers wanted to wait until an "upcoming" meeting to announce details of planned unwinding of the central bank's $4.5 trillion in bond holdings. Market participants shrugged off reports US housing starts and building permits were weaker than expected. The news President Trump disbanded the manufacturing council and his strategy & policy forum after a wave of CEOs stepped down from his advisory panels following criticism over the president's reaction to violence in Charlottesville added to concerns about President’s ability to garner support for his pro-growth policy agenda.

European stocks rise

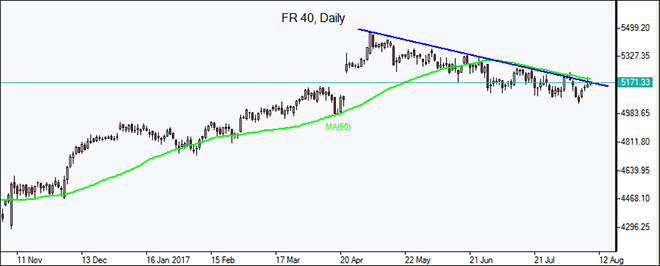

European stocks rose third day in a row on Wednesday helped by weak euro and easing of North Korea tensions. Both the euro and British Pound inched higher against the dollar. The Stoxx Europe 600 index rose 0.7%. Germany’s DAX 30 gained 0.7% to 12263.86. France’s CAC 40 added 0.7% and UK’s FTSE 100 index gained 0.7% to 7433.03.

Unexpected decline in UK June unemployment to 4.4% from 4.5% strengthened the Pound. The 2.1% rise in June wages, including bonuses, was also higher than an expected 1.8% increase. Today inflation data will be released at 11:00 CET in euro-zone, the outlook is negative for euro. And at 13:30 CET minutes of the European Central Bank July 20 meeting will be published. Euro fell yesterday on news ECB President Draghi would not use his Jackson Hole appearance next week to signal ECB policy change.

Asian stocks slip

Asian stock indices are mostly lower today after dovish Fed minutes showed central bankers were concerned about sluggish US inflation. The yen rose against the dollar which weighed on Japanese stocks. The Nikkei ended 0.1% lower at 19702.63 in thin trading despite data showing Japan’s exports rose for an eighth straight month in July. Chinese stocks are mixed : Shanghai Composite Index is 0.7% higher while Hong Kong’s Hang Seng Index is down 0.2%. Australia’s All Ordinaries Index is 0.1% lower with the Australian dollar adding to previous day’s gains against the US dollar as unemployment rate fell to 5.6% in July from 5.7% in line with expectations.

Oil higher after US inventory draw

Oil futures prices are edging higher today after US inventories official report indicated crude inventories dropped by 8.9 million barrels last week. Prices fell yesterday as traders focused on 79000 barrels a day increase in total domestic crude-oil output to 9.502 million barrels a day last week. October Brent crude fell 1% to $50.27 a barrel on Wednesday on London’s ICE Futures exchange.

See Also