The U.S. dollar index (

USDIDX) continued its growth being supported by the data on the state of the U.S. economy. On Wednesday, it rose to the highest level in the last seven weeks at 81.166. Investors reacted positively to the information from ADP. The number of jobs in the private sector in the U.S. for December increased by 238 thousand. This is the largest increase in the last 13 months. Of course, it was better than the prior forecast (200 thousand). Now forex market participants expect that the official data on the U.S. labor market for December will also be positive. Recall that they will come out tomorrow. You can get all the necessary information on macroeconomic events on our website in the"Analysis" - "Economic Calendar".

Today, the BoE and ECB meetings are to be held at 12-00 and 12-45 GMT (0), respectively, The banks will announce their decision on interest rates. No changes are expected. However,

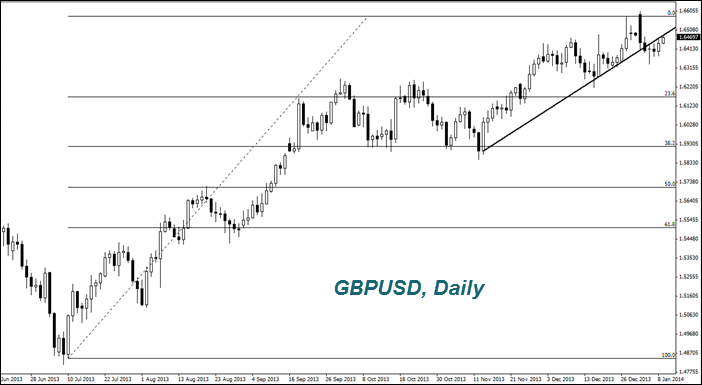

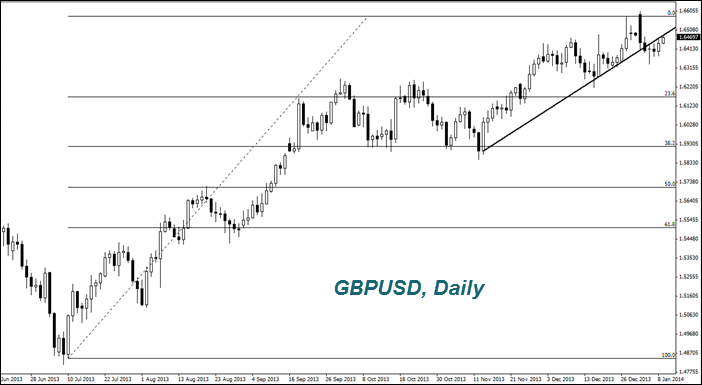

currency rates may be influenced by the statements of the leaders of these banks on further measures to stimulate their economies. Note that earlier there were rumors that the Bank of England may raise interest rate, which now stands at 0.5%. Its representatives said that it will not be long until the unemployment rate falls below 7%. Now it is equal to 7.4%. Regular unemployment data will be released in England on January 22. The EU unemployment rate is much higher (12.1%). Perhaps that is why the ECB attaches its monetary policy to inflation for the year, not to the labor market. Now it is 0.8 %. The target of the ECB is to increase that to 2%. Since the middle of last year, the British pound has strengthened by 5% against the euro and 10% against the U.S. dollar (

GBPUSD). Most market participants believe that the pound is now more stable currency than the euro.

Today, we expect decisions about interest rates in the UK and trade balance for November at 9-30 GMT (0). Eurozone consumer confidence index in December will be released at 10-00 GMT (0). Preliminary forecasts for the pound and the euro are positive. As for Canada, there are the real estate market data (Canadian dollar vernacular) that could affect the course of the Loonie coming out at 13-30 GMT (0). Preliminary forecasts are negative. That is in favor of the

USDCAD on the chart in the trading terminal. However, the loonie has weakened so much against the U.S. dollar over the past three days. Therefore it is difficult to predict the market reaction to economic information. At 23-50 GMT (0), there are the data on the volume of gold-currency reserves in Japan and the indicator of economic activity (leading indicator). We believe that they are able to affect the Japanese yen (

USDJPY) if not coincide with a neutral outlook.

The cost of WTI (OIL) decreased due to the fact that its reserves and reserves of petroleum products in the U.S. were more than expected. Consumption of motor fuel in the country fell to its lowest level in seven months. An additional factor of price drop was the increase of oil production in Libya from 210 thousand barrels per day to 546 thousand

Next Overview (GMT+0, Greenwich): 11:00Questions and suggestions:analytics@ifcmarkets.com