- Analytics

- Market Overview

Euro hits new 7-month low - 23.11.2015

On Friday the US stock indices edged up and the dollar strengthened due to the positive corporate news and anticipation of the Fed interest rate hike. The sportswear producer Nike announced the repurchase of its shares to the value of $12bn which pushed Nike stocks 4.8% higher. The Alphabet stocks climbed 2.4% after the company announced it was to launch a Chinese version of its smartphone Google Play app. Today at 15:45 CET the November manufacturing PMI will be released by Markit. At 16:00 CET the US existing home sales for October will be released. In our opinion, the tentative outlook is negative. Today the financial statements will be released by Tyson Foods and Post Holdings corporations. Note, that on Thursday the US stock exchanges are closed due to the holiday – Thanksgiving Day.

European stocks are slightly correcting down today after the growth on Friday. They were irresponsive to the positive manufacturing PMI in Germany and the whole Eurozone in November that came out early in the morning. Amid the reduced global commodities prices the dependent companies saw their stocks down: Glencore (-6,3%), BHP Billiton (-3,6%), Rio Tinto (-2,3%) and Total (-1,3%). Today no more important macroeconomic news is expected from Europe. The euro slumped to the 7-month low amid the anticipated QE expansion and monetary easing in the ECB meeting on December 3. On Friday the ECB President Mario Draghi said it was essential to boost inflation in the Eurozone.

Nikkei live data show the index advanced on Friday together with other global stock indices. The trade volume was 15% lower the average for 30 trading days. Market participants were risk-averse ahead of the long holidays. Today in Japan is the Labour Thanksgiving Day. The Renesas Electronics stocks advanced 11% after the news on the possible collaboration with the German chip producer Infineon Technologies AG. Sharp is planning to gain positive profit next year which pushed its stocks 4.8% up.

Copper has hit a new 6.5 year record low amid the contracted demand in China and the stronger dollar.

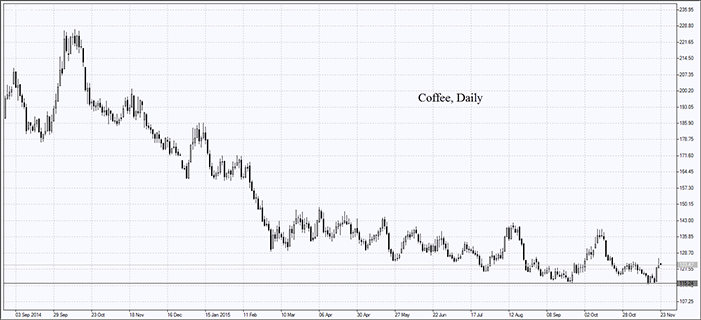

Gold has become cheaper amid the anticipation of the Fed rate hike. The stockpiles of the world biggest gold fund SPDR Gold Trust have reached their low since September 2008 amounting to 660.75 tonnes. U.S. Commodity Futures Trading Commission informed that on the COMEX the net short position in gold has formed for the first time since early August. The net short position in coffee has reached the 2-year high. It was on the increase for 4 straight weeks amid the sideways trend.

The oil prices fell slightly. Investors have paid no attention to the next decreased weekly number of the US drilling rigs. Now 564 drilling rigs are active in comparison to 1574 units in the same period of last year.

The soy prices went down after Maurizio Marsi won the presidential elections in Argentina. During the campaign he promised to lower the export duties.

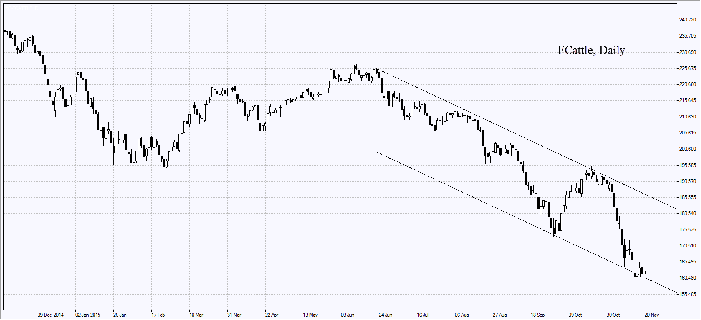

Beef prices edged up after the US Department of Agriculture published the review stating the national cattle livestock decreased 4% from the last year to the lowest since 1996. Nevertheless, this data is better than the more severe slump forecasted by the analysts. For this reason, the beef prices rose less than could have done.

See Also